A Hands on Tool to Teach your Kids the Importance of Investing

Get your Kids excited about saving and Investing

Getting Started Is as Easy as 1, 2, 3.

Buy the Black Inve$ting Box Now!-

Step 1

Buy a Black Inve$ting Box Bundle.

-

Step 2

Spend 30 minutes each week investing in their future.

-

Step 3

Rest assured, their financial foundation is secure.

Great for Home Schoolers

Buy with your ESP Program

Teachers Guide included. Scope and Sequence guide coming May 2024. Learning Points for your Empowerment Scholarship Programs (ESP): Counting, Addition, Subtraction, multiplication, Graphing, Componud interest, Money Management, Budgeting, Goal Setting, and Business Basics.

Get one for each of your kids

The Black Inve$ting Box

Black Inve$ting Box: The Executive Bundle

Share

Unlock a Lifetime of Financial Wisdom

Empower your children with the secrets of money management through play, practice, and participation.

Why is Saving so is Hard?

Kids hate savings for the same reason adults do IT IS NOT FUN, and WE HAVE NO CONTROL.

- In school, kids "waste" their money on candy, clothes, and games; things that are fun.

- Money isn't fun because it grows too slow, and kids can't change that.

- They don't take money seriuosly because we don't set them up to win.

- For most kids, Money is just a tool parents use to say "no" with.

- Most kids won't learn money until its too late; after $60,000 of student debt.

- Many will forever be dependant on thier parents for help even after they are parents themselves.

The Current Tools are to blame.

The Piggy Bank, Envelope system, and Allowance

All traditional tools teach kids that money is slow and limited. Because money is rare, you need to carefully hide it, and never have any fun... but money is not rare. The US mint prints millions of dollars everyday.

Now of course we need to learn to save and budget our cash, but we do that so that we can invest it in profitable ways. We need to give kids a path to success, not a dire warning of scarcity and poverty.

Are you setting your kids up for success?

Are you setting them up to live in your basement?

We need to teach money like we teach sports

Can you image teaching sports that way we teach money?

- Imagine giving a kid spreadsheet instead of a soccerball.

- Imagine giving them a baseball glove, and then locking it in a safe for 12 months.

- Imagine calling double dribble on a 6 year old.

- Imagine making a 9 year old shoot on a 10' basket.

- Imagine forcing an 8 year old to hit a 90mph fastball.

- Imagine telling them not to run or dive becuase they might get hurt.

- Imagine telling them to do it by themselves.

- Imagine never celebrating a win.

The way you teach kids a sport is by letting them play!

That's how we need to teach money.

- Give them fast wins.

- Give them great growth rates.

- Take them to a profesional game, and buy a $17 hotdog.

- Show them that it is fun, and it is going somewhere.

- Spend time one-on-one.

- Let them try and fail

- Let them spend it all

- Let them go into debt

- show them cool tricks to impress their friends

- Give them drills to practice

- Make it a game they can win, and one they will want to play for the rest of thier lives!

The Black Inve$ting Box gets kids excited about financial lessons by giving them the ability to grow their money at an early age. Giving them the power to control their profits will get them invested in the process, and help them make wise financial choices.

- Kids as young as 5 will be passionate about saving, and easily reject frivilous temptations.

- They will beg you to teach them lessons on money management.

- They will develop a sound business acumen by 7years old.

- They will come to you with ideas of ways to help around the house.

- They will volunteer to read books, do the lawn, take out the trash, and even clean up thier rooms.

- They will choose good friends, and develop healthy relationships

- By the time they are 8 or 9, they will be paying attention to the stock market.

- by 10 or 12 they will be starting thier own businesses.

Subscribe to our newsletter

Full of activities for your young investors to enjoy.

Inve$ting Box Refill Kits

-

The Black Inve$ting Box: Box Only

Regular price $15.99Regular priceUnit price / per -

Black Inve$ting Box: The Intern Bundle

Regular price $40.00Regular priceUnit price / per -

The Quarterly Report Chart

Regular price $12.99Regular priceUnit price / per$10.00Sale price $12.99 -

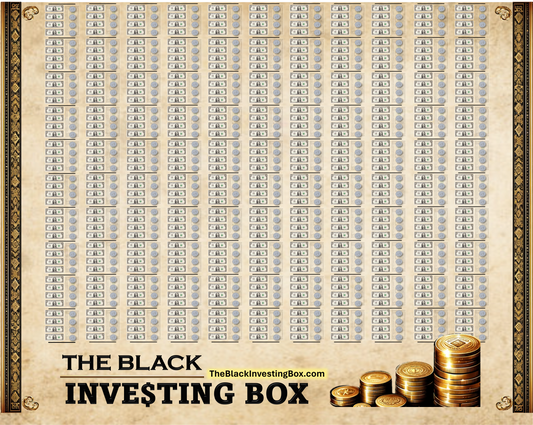

The Compound Interest Chart

Regular price $12.99Regular priceUnit price / per$15.00Sale price $12.99Sale -

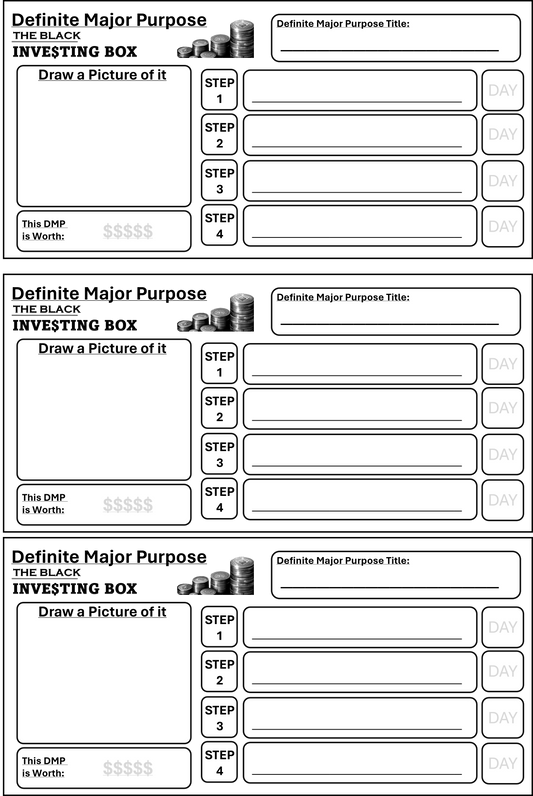

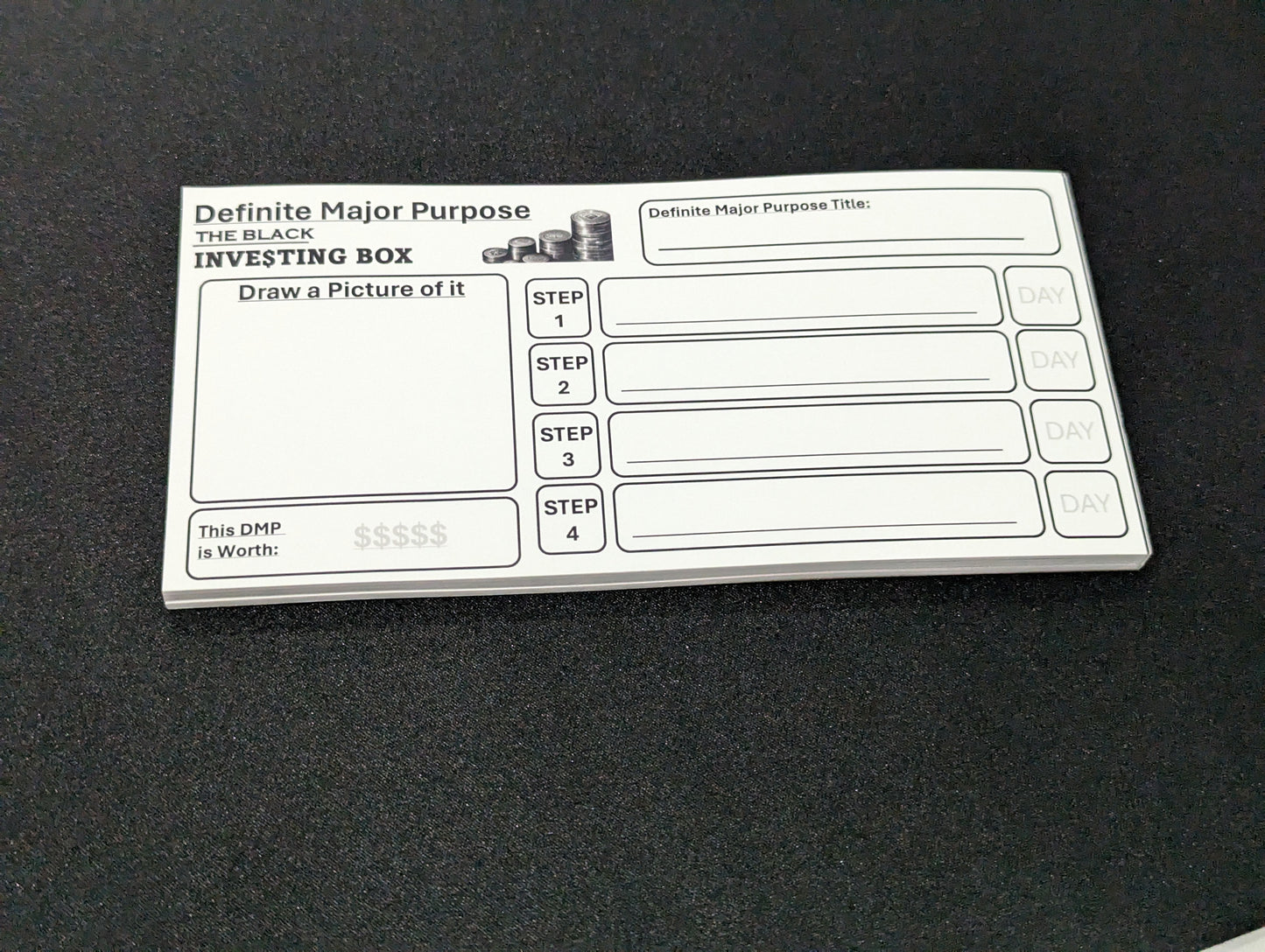

Definite Major Purpose Coupons

Regular price $8.99Regular priceUnit price / per -

Opportunity Contracts

Regular price $12.99Regular priceUnit price / per$0.00Sale price $12.99 -

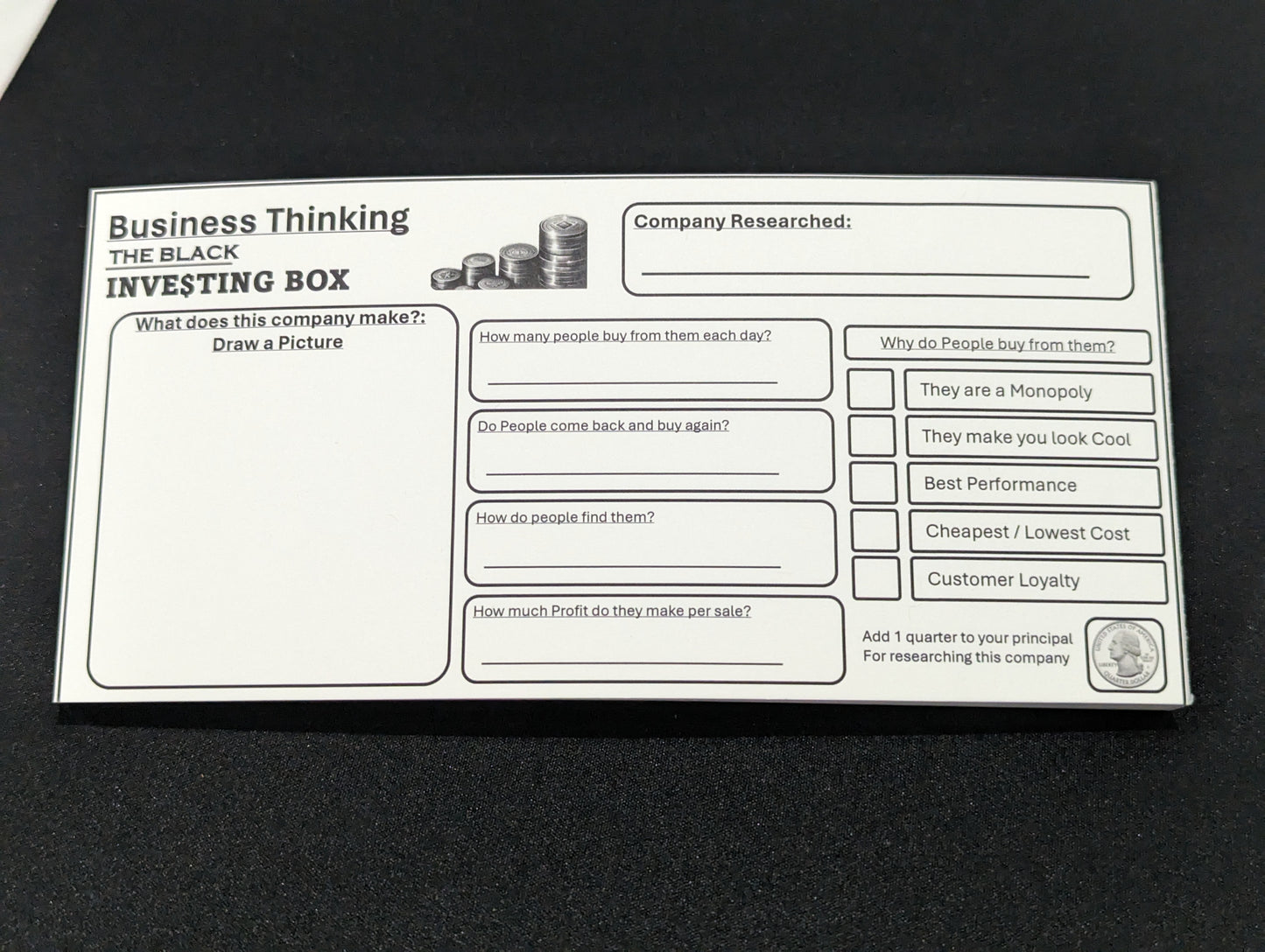

Business Thinking Coupons

Regular price $8.99Regular priceUnit price / per -

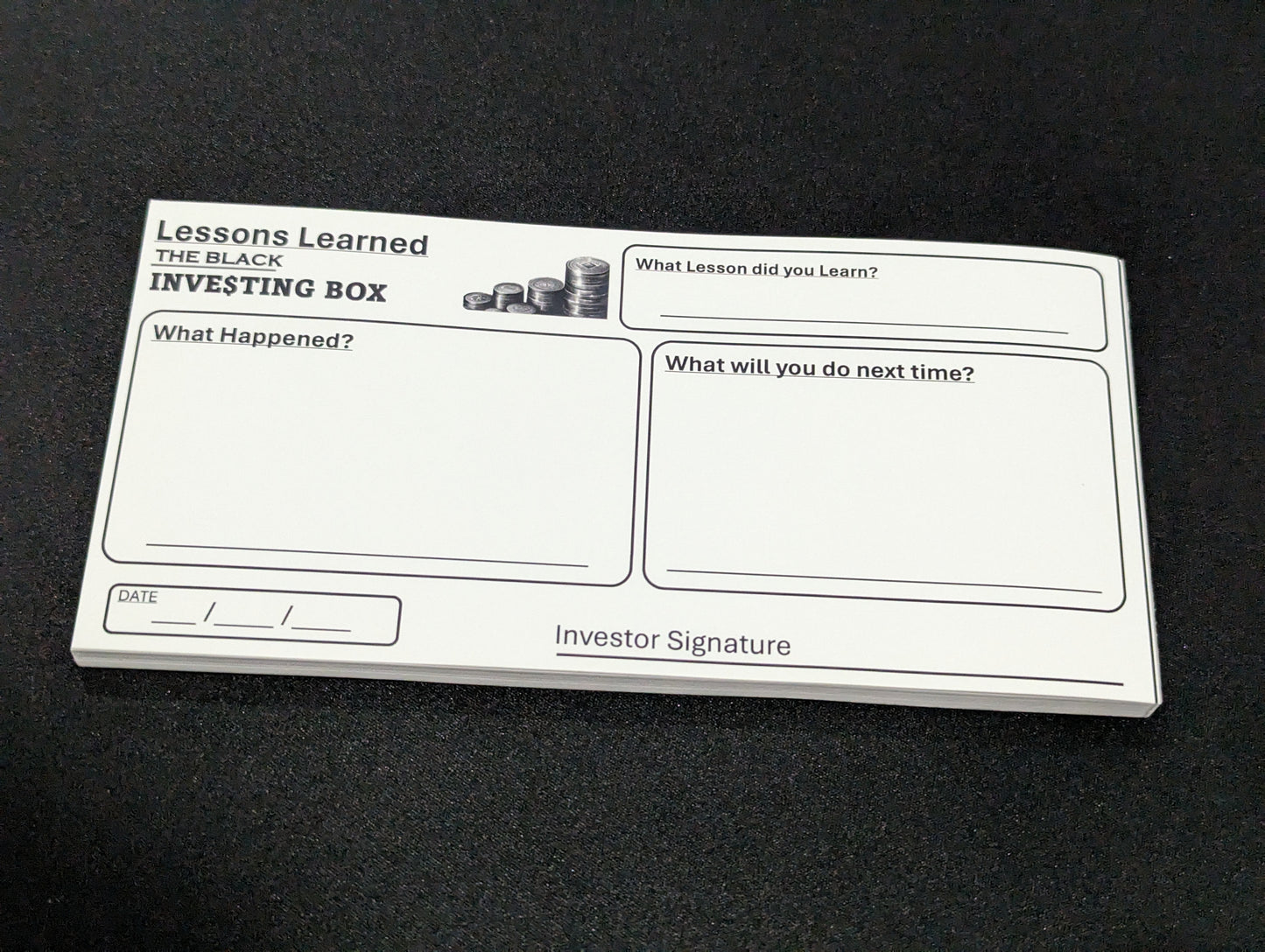

Lessons Learned Coupons

Regular price $8.99Regular priceUnit price / per$0.00Sale price $8.99 -

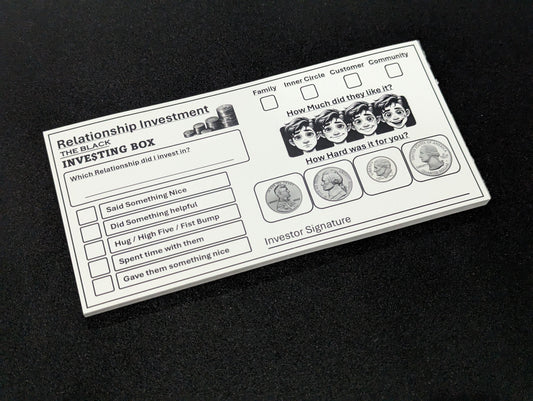

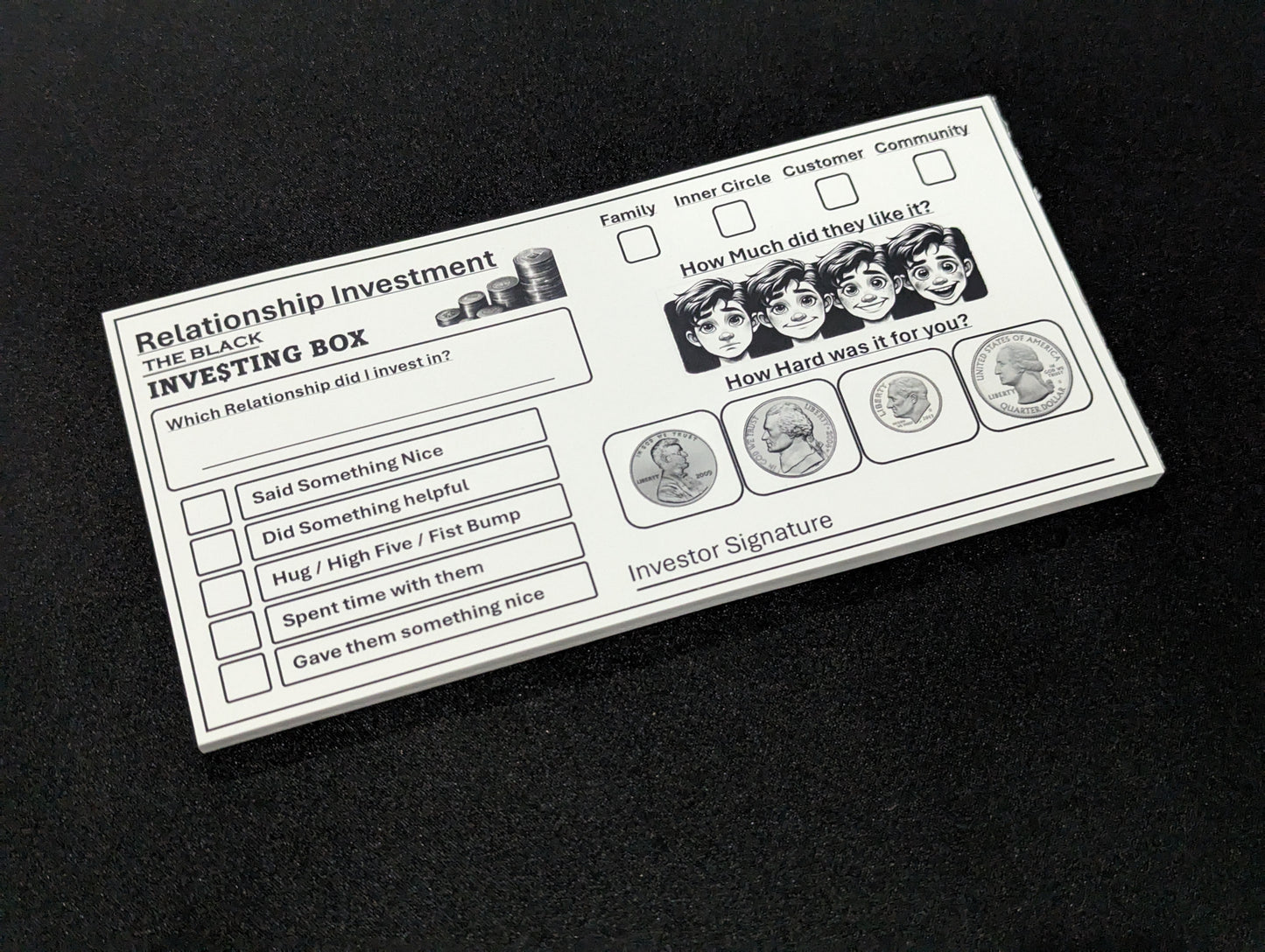

Relationship Investment Coupons

Regular price $8.99Regular priceUnit price / per$0.00Sale price $8.99 -

Definite Major Purpose Coupons: Digital Download

Regular price $2.99Regular priceUnit price / per$0.00Sale price $2.99

Great Financial Books for Kids

-

The Tuttle Twins and the Miraculous Pencil

Regular price $11.35Regular priceUnit price / per$9.90Sale price $11.35Sold out -

The Richest Man in Babylon: The Original 1926 Edition (A George S. Clason Classics)

Regular price $10.89Regular priceUnit price / per$9.90Sale price $10.89Sold out -

Sold out

Sold outRich Dad Poor Dad

Regular price $9.99Regular priceUnit price / per$14.00Sale price $9.99Sold out -

The Tuttle Twins and the 12 Rules Boot Camp

Regular price $10.99Regular priceUnit price / per$9.90Sale price $10.99Sold out